Business Insurance in and around New Braunfels

Get your New Braunfels business covered, right here!

Helping insure small businesses since 1935

This Coverage Is Worth It.

It takes courage to start your own business, and it also takes courage to admit when you might need a hand. State Farm is here to help with your business insurance needs. With options like business continuity plans, extra liability coverage and worker's compensation for your employees, you can feel comfortable that your small business is properly protected.

Get your New Braunfels business covered, right here!

Helping insure small businesses since 1935

Cover Your Business Assets

Whether you own an ice cream shop, a HVAC company or a lawn care service, State Farm is here to help. Aside from remarkable service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

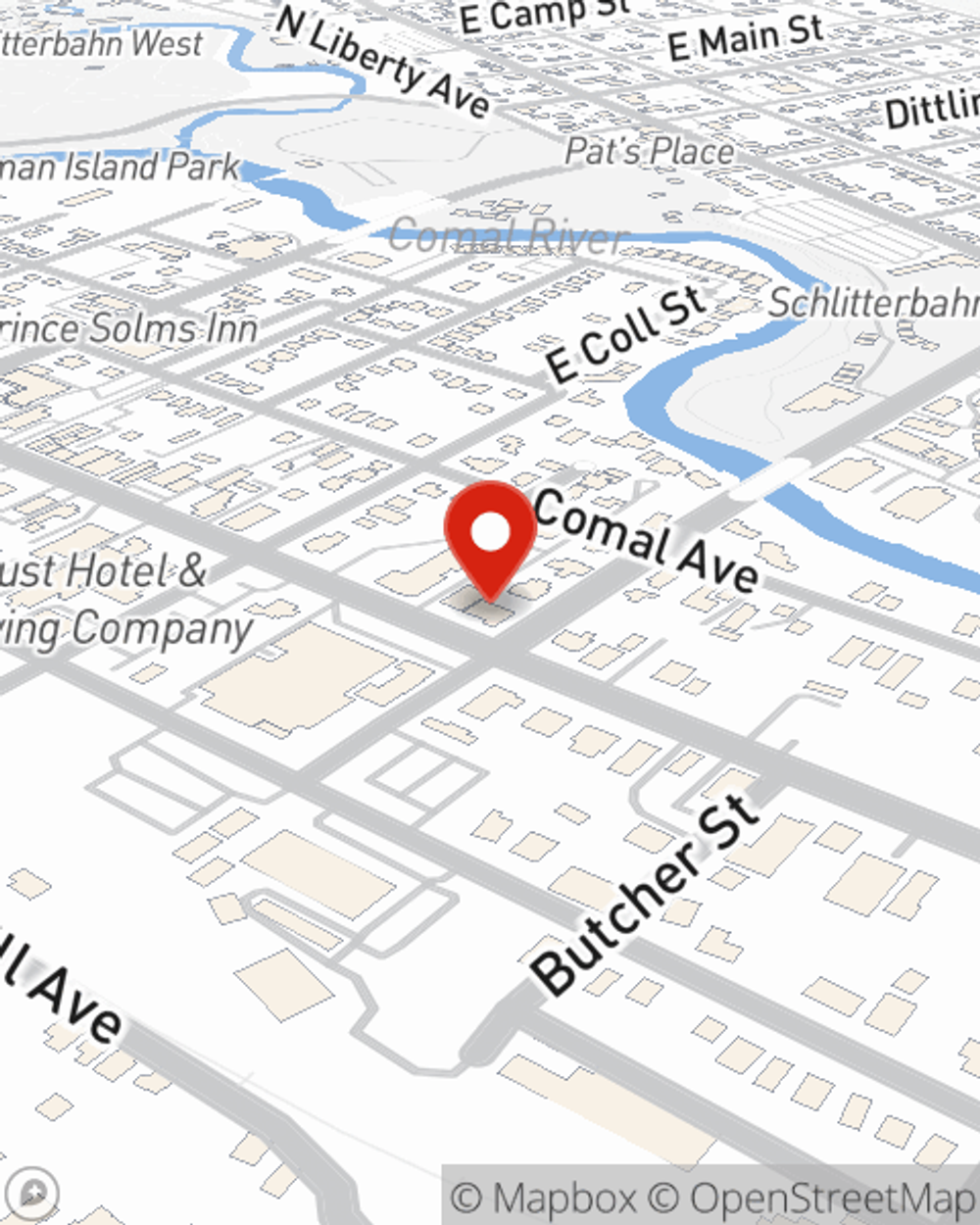

Get right down to business by contacting agent Bill Mehrer's team to discuss your options.

Simple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Bill Mehrer

State Farm® Insurance AgentSimple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.